It can be difficult to get started saving for your future when there are always things in the present clamoring for your money. For many people, the thought of investing in stocks seems like little more than a distant dream. The reality is that the only way to make positive progress in your financial situation is to find a way to save and invest. If you want to get started investing, there are a number of free apps designed to help you invest even if you only have a few dollars to put into stocks each month.

The younger you are when you get started on the process of saving for your future the faster the money will grow. When you invest money in stocks that money has the potential to earn interest. When you earn interest, that money is reinvested in the stock market and it starts to earn interest. This process is called compounding and it is a valuable tool when it comes to saving for your future. There are a number of tools available that will let you get started investing with very little money. Choose one of the free investing apps and invest something toward your future. Consistently investing – even small amounts – is one of the most effective ways to save and build wealth. Four of the best free apps and websites for stocks include Acorns, SoFi, Robinhood, and M1 Finance.

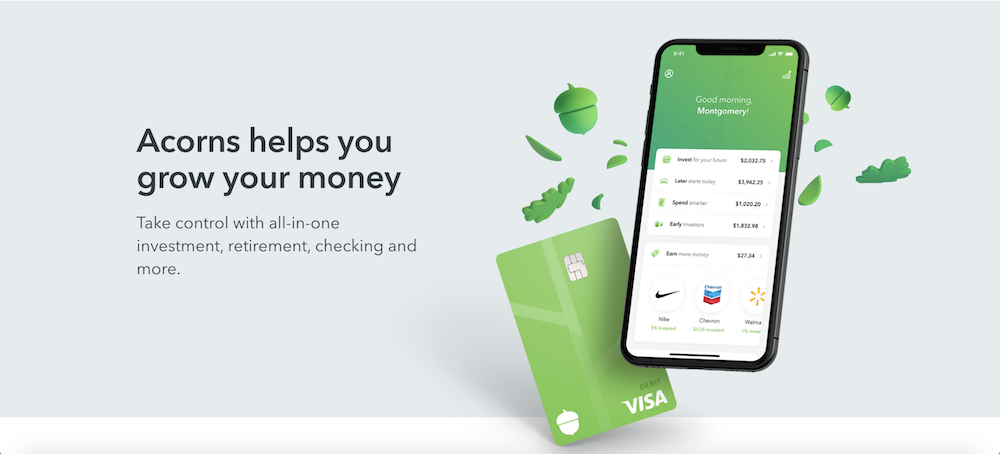

Acorns

The Acorns app is an investing tool that allows you to automatically invest money. The model is designed to round up each of your purchases in connected accounts and invest those roundups. For example, if you spend $3.50 on a latte, it will round the purchase up to $4.00 and put the extra .50 cents into your investment account. Each investment is small but it can add up over time, especially if you keep roundups turned on. You can also set up recurring investments to be transferred into your account on a weekly or monthly basis. These recurring investments are separate from your roundups and can be set to any amount you want. The combination of recurring investments and roundups is the most effective way to build up your investments through the Acorns app. The app will automatically invest your money in the stock market based on your preferences. You can choose to invest aggressively or more moderately. When you set up your profile on the app it will ask you questions to help you determine how aggressive or conservative you should be with your investments. The Acorn app itself is free. If you choose to set up roundups and recurring investments there is a fee associated with that. There is a flat fee of either $1 per month, $3 per month, or $5 per month depending on which plan you choose. Acorns also offers cash back at some retailers which can add to your investment funds.

SoFi

SoFi is a free investment app and suite of financial products that can help you reach your financial goals. You can get started investing with SoFi with as little as $1. You can set up automated investing every month or make a one-time investment. SoFi will automatically rebalance your investments on a predetermined schedule to ensure that your money is working its hardest. In addition, SoFi will make sure your money is diversified to minimize risk and maximize earnings. When you become a member of SoFi, you get access to a long list of benefits. These benefits include free career counseling, estate planning services, and access to a financial planner for free.

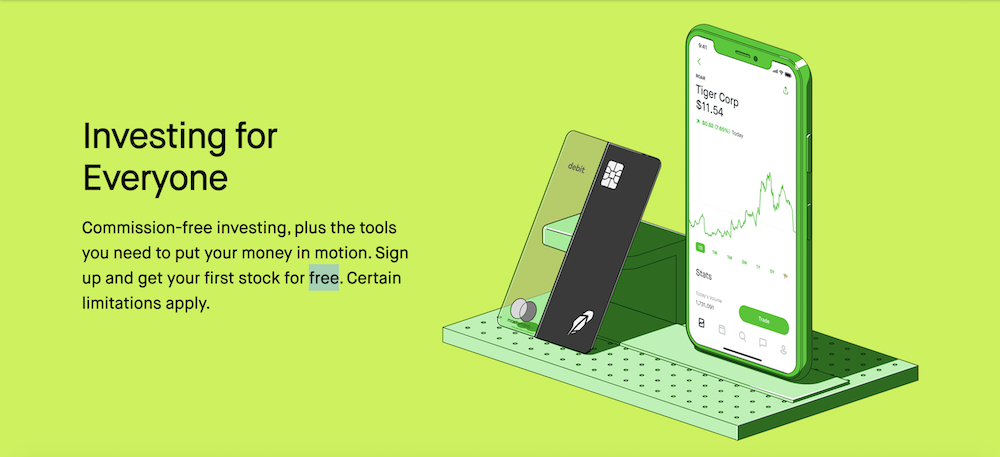

Robinhood

Robinhood is an investing app that is free to download. Robinhood offers commission-free investing which means that you can save on costs that are typically associated with investing. You can get started investing in the app with as little as $1. If you want more than just the basics from Robinhood you can check out their Gold program which costs $5 per month. Robinhood also offers education services so you can learn more about the process of investing.

M1 Finance

M1 Finance is another free investing tool that has an app and a website. With M1 Finance, you have a little more control over your investing strategy. You develop a customized investing strategy based on your goals, risk tolerance, and timeframe. Once you have set up your investment strategy, M1 Finance automates it to make it easy for you to invest consistently over time. There is no cost to invest through M1 Finance which makes it a great option if you are trying to maximize the money you invest.

Investing in stocks is an important part of a quality financial plan. There are a couple of things to keep in mind as you consider your options for investing. First, it is possible to lose money in the stock market. Stocks can be volatile which means that their worth can rise and fall. The key to minimizing risk is to diversify your investments – don’t put everything in a single stock! Second, it takes time for money to grow in the stock market. Investing in stocks should be part of your long term strategy. As your money earns interest your investment will grow and that interest will eventually start to earn its own interest. If you leave your money invested the growth will continue to compound and provide you with an even better return.

Investing in stocks can feel overwhelming and confusing. Fortunately, there are apps available that allow you to start with small investments, do not charge hefty fees, and provide valuable learning tools. Start small with one of the apps listed above and learn about investing. Getting started with savings and investing now will set you up for a better financial future. Taking the necessary steps to get out of debt and committing to the process of saving and investing are the key elements to a brighter financial future.

Other Posts

The Best Free Stuff Students Can Get Online

College students may acquire a lot of free goods if they know where to search. We’ve compiled a list of discounts and freebies for college students that will save you a ton of money! If you like free stuff, check out our ultimate guide to the best free stuff anyone can get online. Free Amazon…

Read MoreThe Best Free Stuff For Active Military & Veterans

Military members sacrifice so much, yet they are among the lowest-paid in the nation. In exchange for subsidized housing and healthcare, military families are left with much less cash to use for other living necessities and luxuries. In acknowledgment of the great sacrifices that military personnel, families, and veterans make, many companies and organizations have…

Read MoreHow To Get The Best Free Stuff For Parents

Preparing for a new baby is an exciting time. You get to set up a new nursery in your home. You’re choosing baby names to call them. But the truth is that having and raising a baby gets expensive. Suddenly you’re looking everywhere for free stuff for parents. You’re always on the lookout for baby…

Read More